The freight sector in the Black Sea region is influenced by multidirectional trends. On the one hand, the small tonnage sector is subject to weakness and congestion, which puts pressure on freight rates, causing them to decrease. Unstable demand for the transportation of Ukrainian grain, the key cargo for the region, also adds volatility to the rates.

Nevertheless, an increase in Ukrainian grain exports by sea, especially through Odessa ports, stimulates demand for transportation and supports freight rates to increase. The strengthening of grain prices in Ukrainian ports above $150/ton, driven by renewed demand in end markets, also has a positive impact on freight rates. However, attacks by Russian troops on Dunay port infrastructure and possible restrictions on imports of Ukrainian agricultural products to the EU, especially from France, are negative factors that may reduce demand and freight rates in relevant directions.

On the other hand, the development of the grain corridor “Ukraine – ports of Romania and Bulgaria” creates prospects for growth of demand and freight rates in this direction, making it one of the key grain trade markets in the North-West Black Sea region.

The freight market in the Mediterranean region is also characterized by mixed trends. As in the Black Sea, the light tonnage sector is experiencing weakness and congestion, putting pressure on freight rates. However, some cargo flows, such as steel products and fertilizers, are seeing a revival in demand, allowing shipowners to obtain higher rates.

Overall, a lack of new cargoes and excessive tonnage supply will restrain the growth of freight rates in the Mediterranean region. However, the temporary revival of certain cargo flows may keep rates at higher level on respective directions.

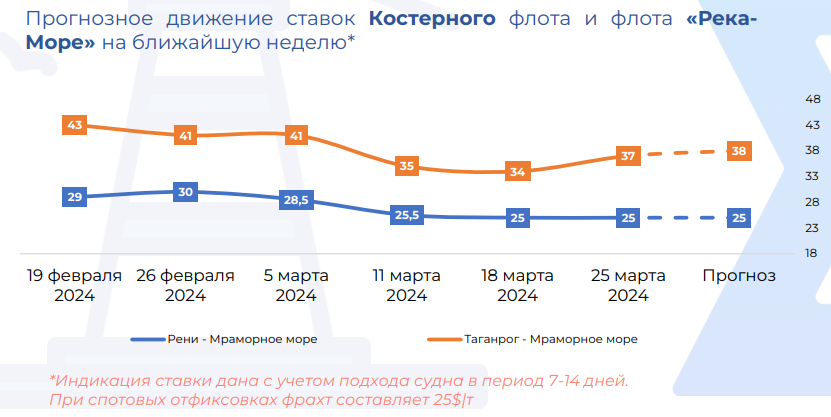

The situation on the Azov Sea freight market looks more optimistic. Owners of river vessels were able to increase rates for transportation of grain bran and wheat from Russia to Turkey due to the growth of trade volumes and the shortage of open vessels. However, rates for shipments to Caucasus ports remain less attractive compared to international voyages – around $16-17 per ton. Long voyages are also in high demand, with rates in the mid-$60s per tonne for wheat and other grains from Azov to Mersin and low-to-mid $70s per tonne to the Italian Adriatic.

The forecast expects continued volatility and generally low levels of freight rates in the region until the balance of tonnage supply and demand is restored by new sustainable cargo flows.

+380 67 625 91 65

+380 67 625 91 65