The Black Sea market is facing an increasing problem of vessel downtime, which can last from 7 to 10 days or even longer. These force shipowners to be more flexible in the face of increasing competition and reduce the overall profitability of vessels amid a lack of active cargo flows.

The main commodities transported in the region remain grain from Ukraine’s deep-water ports, construction materials and minerals from Turkey. Many companies survive, mainly due to the transportation of grain cargoes, which provide a minimum level of activity in the market. High competition among short sea vessel owners forces them to reduce rates or accept less profitable routes to avoid idle vessels.

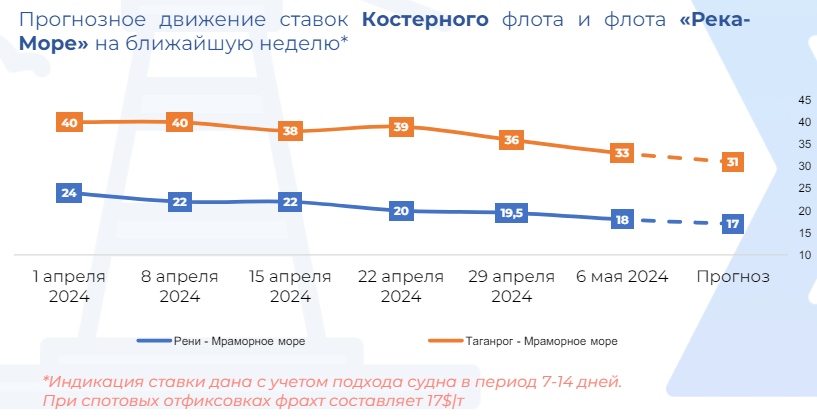

In the Mediterranean region, Egyptian fertilizer shipments enjoy stable demand, which supports economic activity and provides shipowners with stable income. By the end of the week, there is a decrease in rates for transportation from European, Russian and Middle Eastern ports, which leads to a decrease in the overall profitability of voyages. Due to fierce competition and a reduction in cargo traffic volume, rates are decreasing by $0.5–1 per ton, and for shipments from Ukraine – by $1–1.5 per ton.

The Azov Sea has seen the most significant decline in freight rates. Nevertheless, the underlying position of shipowners remains relatively favorable due to stable demand for grain and coal transportation from Russia to Turkey. Transportation from Russia to Turkey remains profitable due to temporary charter rates that exceed operating costs by 20–30%, even in the presence of delays and long downtime. Unfavorable weather conditions and tighter control measures in the Kerch Strait are leading to an increase in vessel downtime, forcing shipowners to accept lower rates.

+380 67 625 91 65

+380 67 625 91 65