The light tonnage segment of the Black Sea market maintains its depressed dynamics despite small signs of activity. Bosphorus Strait has been experiencing downtime due to weather conditions in recent weeks, but this had little effect on the number of vessels in the region, causing the existing surplus of tonnage.

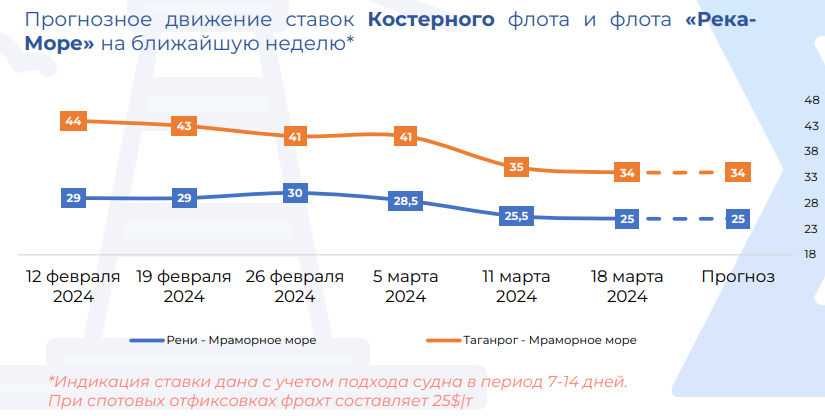

During the week, freight rates from Ukrainian ports decreased by $1.5-3 per ton, and from Romanian and Bulgarian ports by $0.5 per ton. Low demand from key importers in Turkey, North African countries and the European Union puts pressure on prices for exported goods from the Black Sea.

The Ukrainian sea corridor has started operating around the clock, which may contribute to a 20% increase in export volumes. However, the outlook for the coming weeks remains pessimistic due to low demand and excess tonnage in the region. Consequently, no significant improvement in the situation should be expected, and freight rates are likely to continue to decline.

The eastern part of the Mediterranean Sea shows more active trade compared to the Black and Azov Seas. Demand for tonnage in this region is supported by shipments of steel products, scrap metal, fertilizers and mineral cargoes, though not too active.

However, it becomes more difficult for local shipowners to keep stable freight rates due to increasing competition. The situation in the eastern part of the Mediterranean Sea seems to be the most stable, regular cargoes of ferrous metals, fertilizers and minerals remain, which should support rates in the coming weeks. However, after the holidays, high competition and weak import demand may lead to lower rates.

The Azov Sea market started to lose ground again after a significant drop last week. Road transportation of cargoes is growing, but weak demand for wheat and coal in Turkey forces shipowners to make concessions on rates. Freight rates in this region decreased by $1-2 per ton, but remain higher than in Black Sea ports.

The forecast for the next 2-3 weeks points to the preservation of a downward price trend in the Azov Sea market. Despite acceptable profitability, exceeding operating costs by 70-80%, shipowners will have to reduce rates due to weak demand, especially for vessels with a deadweight of 5-6 thousand tons.

+380 67 625 91 65

+380 67 625 91 65