The Black Sea small tonnage charter market continues to be challenging, despite increased activity in the new grain season. Supply of grain cargoes, especially from Ukraine, remains limited and an excess of open vessels is putting pressure on freight rates. Lack of significant offers for steel, coal and fertilizers also complicates the situation. Unstable demand for transportation makes the market vulnerable to changes in cargo supply dynamics. In the Black Sea, shipowners face difficulties in increasing freight rates. For example, rates for 3-4,000 tons of wheat from Izmail to Greece are discussed at $21/t, which corresponds to $1-1.5 thousand per day. Forecasts for the Black Sea remain cautious. Without a significant increase in demand for grain and other cargoes transportation, freight rates are unlikely to grow significantly.

In the Mediterranean Sea, the market for small-capacity chartering is also experiencing significant difficulties. The main problem remains the mismatch between the number of available vessels and the demand for transportation. Despite stable fertilizer and steel flows, the market remains under pressure due to a surplus of available vessels. Fertilizer shipments from Egypt are regular but do not affect market sentiment. Shipowners have to accept low rates to fill their vessels. For example, the transportation of 3,000 tons of scrap from Thessaloniki to Aliaga is negotiated at $45k lump sum rate. This highlights the low level of demand for transportation and the limited opportunities for shipowners to improve profitability. Forecasts for the Mediterranean Sea remain subdued. Shipowners and brokers are hoping for an increase in fertilizer and steel exports, which could improve the situation, but with the current uncertainty, any improvements will be limited.

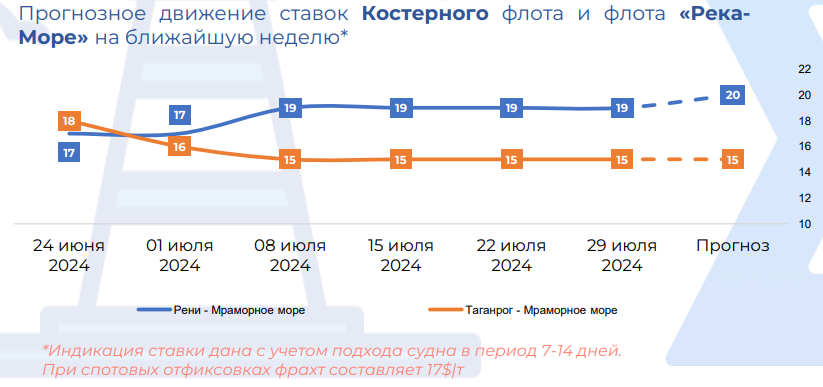

In the Sea of Azov the market for small tonnage vessels freight shows signs of moderate growth. A slight increase in activity is due to the growth of grain cargoes and other agricultural products, especially in Turkey and other countries. Shipowners are trying to raise rates, despite pressure from an excess of vessels. For example, rates for the transportation of 3,000 tons of wheat from Rostov to Batum are discussed at $19/t. The situation with other cargoes remains stable. However, the overall market remains challenging due to the high level of vessel supply. Forecasts for the Sea of Azov remain cautious. Without a significant increase in demand for grain and other cargoes transportation, freight rates are unlikely to grow. Shipowners hope for an improvement in the situation, but the current excess of tonnage and weak demand limit market growth opportunities.

+380 67 625 91 65

+380 67 625 91 65