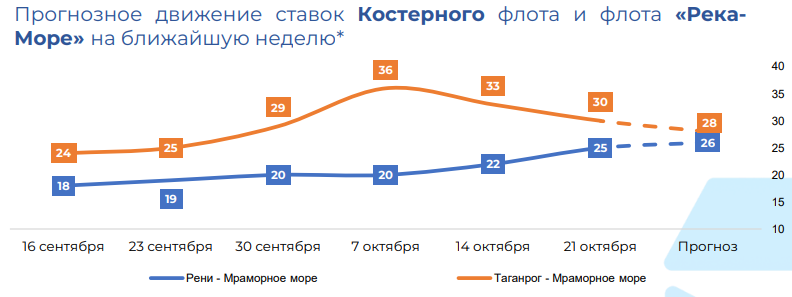

The Black Sea market demonstrates gradual growth in activity, which is connected with increase in supplies of Ukrainian grain. Vessel owners continue to refuse to call at Greater Odessa ports due to risk of missile attacks, which leads to shortage of small capacity vessels. This, in its turn, pushes freight rates upward. The growth of rates for transportation from deep-water Ukrainian ports and Danube is especially noticeable. Factors influencing the growth of rates in the region include high demand for Ukrainian grain, reduction of available vessels and stabilization of export prices for wheat and corn. The outlook for rates for the future period remains positive, although the rate of growth may slow. If grain export prices continue to decline, this will have a dampening effect on rates. Nevertheless, seasonal growth of cargo traffic at the end of the year and continuing shortage of small-capacity vessels will keep rates stable.

The Mediterranean market is also experiencing a revival, especially in the segment of fertilizer shipments such as Egyptian urea. Vessel owners are looking to raise rates, but charters have so far been successful in restraining their growth. Factors affecting the market include strong demand for the transportation of fertilizer and steel sector cargoes. At the same time, the abundance of vessels and lower fuel prices give charterers reasons to keep rates at the level of the previous week, despite attempts by shipowners to raise them. Forecast of rates for the future period is neutral. The market is expected to remain stable, with possible minor fluctuations depending on demand for fertilizers and steel products.

The situation on the Azov Sea market remains unstable after the recent significant reduction of rates. Activity on the market has stabilized, but negative pressure remains. Grain and coal transportation rates continue to fall, despite attempts by vessel owners to slow down the decline. Factors putting pressure on rates include the introduction of new Turkish wheat import regulations, which limit volumes of grain shipments from Russia. At the same time, an increase in the number of available vessels and a decrease in activity on the market contribute to a further decrease in rates. Forecast of rates for the future period remains pessimistic. It is expected that rates will continue to decrease, especially if demand for grain transportation does not recover.

+380 67 625 91 65

+380 67 625 91 65