The situation on the Black Sea freight market remains extremely difficult for shipowners. The market is characterized by excessive tonnage and a lack of new requests for transportation, which leads to constant pressure on freight rates. For example, transportation of 6000 tons of wheat from Izmail to Lebanon is offered at $19/t and from Izmail to Alexandria at $22/t. Transportation of 5,000 tons of coke from Constanta to Bilbao is discussed at $40/t, and transportation of 2–2,500 tons of scrap metal from Bulgaria to the Marmara Sea is estimated at $18–19/t. There is also low activity in the steel transportation segment, and Charterers are ready to pay a maximum of $16/t for transportation of 3,000 tons of steel from Novorossiysk to Izmit. Absence of wheat imports by Turkey minimizes demand for tonnage in the region, which results in freight rates decreasing by $0.5-1/t.

The Black Sea coaster market is not expected to improve significantly in the coming weeks. The market can only be supported by increased demand for grain in Egypt, North African countries and EU, but so far this is not happening.

The situation in the Mediterranean freight market also remains challenging. Low activity and limited cargo supply in all parts of the region are putting pressure on freight rates. The influx of vessels from the Continent complicates the situation in the western part of the basin, where vessels are considering ballasting to the eastern Mediterranean in search of work. However, cargo supply remains modest and freight rates continue to decline, forcing shipowners to bargain at lower prices. Activity of fertilizer shipments from Egypt, the traditional market driver, is extremely low, which also aggravates the situation. The outlook for the near future is unfavorable: a lack of significant increases in grain demand will continue to pressure the market, and freight rates in the Mediterranean are likely to remain at low level or continue to decline.

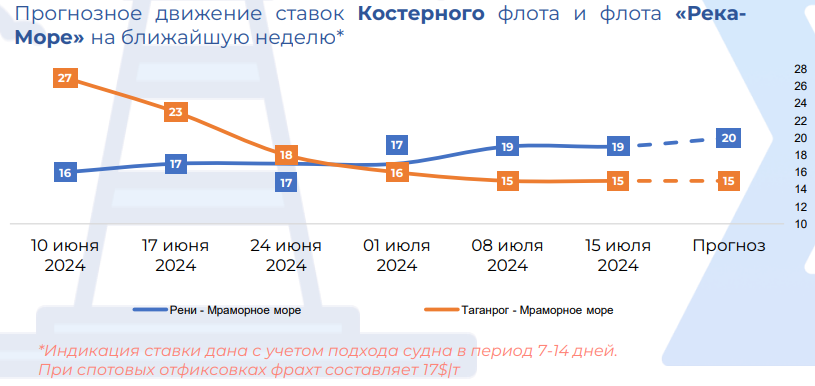

The situation on the Azov Sea freight market is also complicated. Cargo offers are sporadic, and the excess of available river-sea vessels leads to record low freight rates. For example, for the transportation of 3000 tons of corn from Azov/Rostov to Marmara Sea. Charterers offer $14-15/t, while shipowners try to get at least $16/t. For other cargoes, the situation is not better: traders are not ready to pay more than $12/t for 3-5000 tons of coal transportation from Rostov to Black Sea ports. These low rates have not been seen since May-June 2019. Lack of wheat imports by Turkey and minimal tonnage demand in the region continue to drive freight rates down by $0.5-1/t over the last week. The outlook for the near future is extremely unfavorable: the lack of a significant increase in grain demand in Egypt and other countries, as well as the ban on wheat imports to Turkey, will continue to put strong pressure on the market.

+380 67 625 91 65

+380 67 625 91 65