In the Black Sea, there is a steady strengthening of freight rates, which is due to a number of key factors. First, grain supply has increased, mainly from Ukraine. This creates a deficit of available vessels, especially in the western part of the Black Sea. And this allows shipowners to set higher rates for transportation. Especially noticeable is the growth of rates in the directions to Greece and Italy, where there is still a high demand for Ukrainian grain. In addition, the wave of attacks on Ukrainian port infrastructure also indirectly contributes to the growth of rates in neighboring countries, such as Romania and Bulgaria. Against the backdrop of the recent increase in Ukrainian corn export prices, charterers and shipowners see additional opportunities to increase their market positions. The outlook for the Black Sea remains optimistic. Demand for Ukrainian agricultural cargoes is expected to be consistently high, especially ahead of the end of the year. This will create additional opportunities for shipowners to increase rates, supported by rising grain prices and the stabilization of vessel supply.

There are mixed dynamics in the Mediterranean Sea. The number of available vessels satisfies current cargo flow, but shipowners continue to insist on rate increases. This happens against the background of freight rate growth in the Black Sea, which adds pressure on charterers. The most noticeable growth in rates is observed in the segment of grain and fertilizer transportation. Fertilizer exports from Egypt to Southern Europe are at rising rates as demand for these cargoes remains stable. There is also a revival in the metals sector, especially in steel and metals shipments from the Mediterranean to North Africa and Eastern Europe. The outlook for the Mediterranean looks cautiously positive. An increase in cargo transportation volumes is expected, which may lead to further growth in rates.

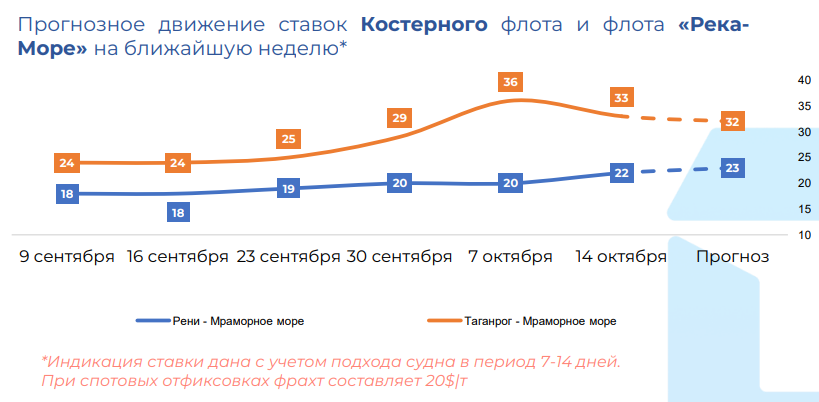

The Azov Sea market has seen significant changes in recent weeks. After several weeks of rising rates, the market has changed direction sharply. The new rules on wheat imports to Turkey led to limitations on imported wheat volumes, which reduced grain supply for transportation and put pressure on rates. Grain transportation rates decreased, and shipowners had to adjust expectations. At the same time, demand for coal transportation slightly revived, allowing coal exporters to compete for available vessels. The forecast for the Sea of Azov remains uncertain: new Turkish regulations will continue to put pressure on the market. However, as winter approaches, demand for coal and other cargoes is expected to increase, which may help stabilize freight rates.

+380 67 625 91 65

+380 67 625 91 65