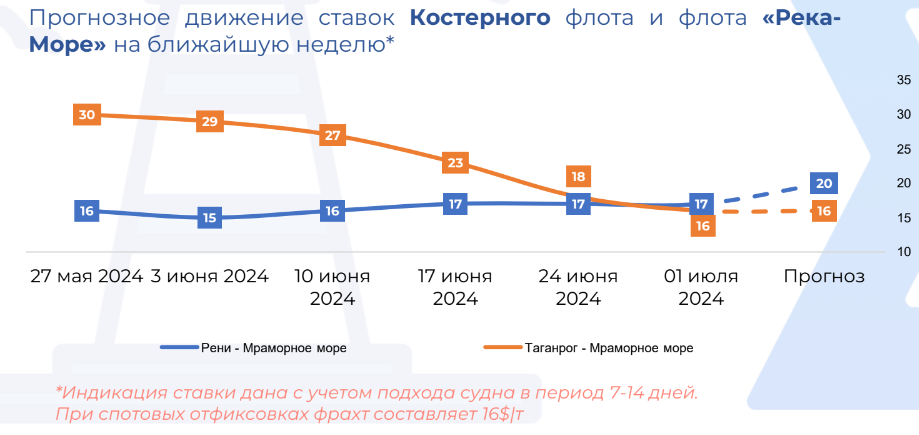

The current situation on the Black Sea freight market is characterized by excessive tonnage, which puts pressure on freight rates. Despite attempts by shipowners to raise rates, success has been limited, especially with the start of the new grain season. The market is also affected by the lack of wheat supplies to Turkey and weak demand for Russian grain in Iran, leading to lower rates in the Azov and Caspian Seas. Forecasts for the Black Sea freight market remain cautious. Freight rates may remain low in the coming weeks. Shipowners will be forced to make concessions to keep their vessels busy, which may lead to further reductions in rates.

The current situation in the Mediterranean freight market remains challenging due to the imbalance between supply and demand for tonnage. Trading has slowed down due to industry events in Istanbul and the absence of many market players. Freight rates remain under pressure, and vessel owners are often willing to make concessions in a highly competitive environment. The situation in the steel segment also remains challenging. A deal to transport 1600 tons of steel from Izmir to Western Greece was concluded for about $18 per ton. No significant improvements are expected in the Mediterranean market in the near future. High competition and excess tonnage will continue to put pressure on rates. However, the gradual recovery of demand for grain and fertilizer transportation may bring some stability.

The current situation on the Azov Sea freight market remains tense due to a lack of cargoes and excess tonnage. Freight rates continued to decrease, reaching minimum levels, as the current daily revenues of shipowners are 2.5–3 times lower than operational costs. To ship 3-5,000 tons of corn from Yeisk to the Marmara Sea, rates are $14-15 per ton, which barely covers operating costs. Some charters are offering $16 per ton for a 3,000 tons of corn shipment from Azov to the Sea of Marmara with loading dates in early July. The outlook for the Sea of Azov remains pessimistic. No significant improvement is expected in the near term, as excess tonnage and weak demand continue to put pressure on rates.

+380 67 625 91 65

+380 67 625 91 65