The freight market for small-tonnage vessels in the Black Sea continues to show weak activity. A key factor is the decline in Ukrainian export volumes, particularly in the grain transportation segment, which has further reduced demand for spot tonnage. The end of Ramadan and the removal of import duties on grain in Turkey did not generate the expected boost in trading activity. Vessel owners are attempting to maintain current freight rates, offsetting low demand through bunker cost savings. Scrap metal shipments from Romania remain steady and provide limited support to specific trade routes. Some shipments from Bulgaria are also ongoing, albeit at a limited scale. Overall, the market is experiencing an oversupply of vessels, especially in the 4,000–8,000 deadweight tonnage range. Market sentiment remains uncertain in the near term as weak export demand continues to meet excess capacity.

In the Mediterranean, the market shows more signs of life. The reporting period saw an increase in cargo offers, particularly for fertilizer and steel shipments. Trader activity has grown, though the presence of sufficient open tonnage continues to cap freight rate growth. That said, there is visible momentum in fertilizer contracts, especially on routes originating from Egypt. For now, shipowners are not facing major loading difficulties, though rising fuel prices could shift the balance in their favor. Freight activity for steel cargoes from Southern Europe is also providing moderate support, with some contracts closing above market average due to urgent timelines or logistical specifics. Overall, the small-tonnage freight market is showing signs of stabilization, with potential for rate increases as the May holidays approach and voyage costs rise.

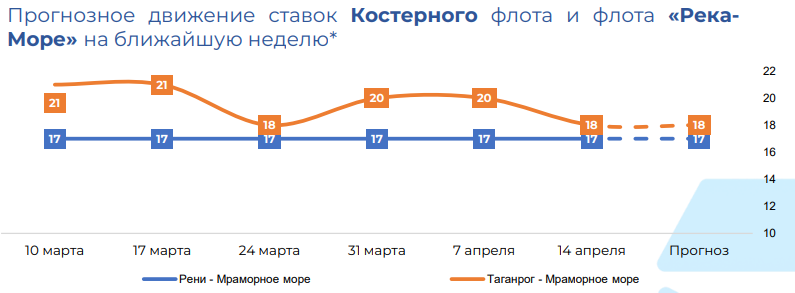

The Azov Sea region remains under pressure due to low export activity and a notable increase in vessel availability in mid-to-late April. Despite the end of the holiday season, demand for Russian wheat from major importers such as Turkey and Egypt remains weak. This is particularly evident in shallow-water ports, where operators are already adjusting to lower freight levels. The supply of tonnage consistently exceeds demand, leaving little room to maintain rates at acceptable levels. Outside of grain transportation, there is some movement in coal shipments, but traders are offering minimal freight levels there as well. Increased competition among vessels—particularly river-type ships—is adding further pressure on owners, pushing them toward rate concessions. The outlook remains pessimistic: without a significant rise in export volumes, the prospects for market stabilization in this region are extremely limited.

+380 67 625 91 65

+380 67 625 91 65