Freight rates continue to decline in the Black Sea market. The main reason is the reduction of grain cargoes, especially from Ukraine, which remains a key player in the region. The recent international grain conference in Geneva led to a sharp decrease in the number of spot deals. At the same time, the surplus of available vessels, especially in the 7–12 thousand tons segment, increases pressure on rates. Over the past week, the cost of transportation from Ukrainian ports has noticeably decreased, while from other ports in the region a slight decrease was also noted. In the near future, the situation may worsen if prices for exported grain remain low and demand for freight does not increase. Only seasonal deterioration of weather conditions or growth of grain prices can provide some support to rates.

The Mediterranean market shows more stable dynamics due to the increase in urea shipments from Egypt, which allows shipowners to keep rates at their current level. However, in the western part of the region, cargo shortages are forcing shipowners to consider long ballast crossings in search of work. The eastern Mediterranean offers more loading opportunities, but with activity low, rate increases are unlikely. Unless urea or other cargoes grow, pressure on the market will remain. With excess tonnage, charterers continue to dictate terms, especially in the western part of the region.

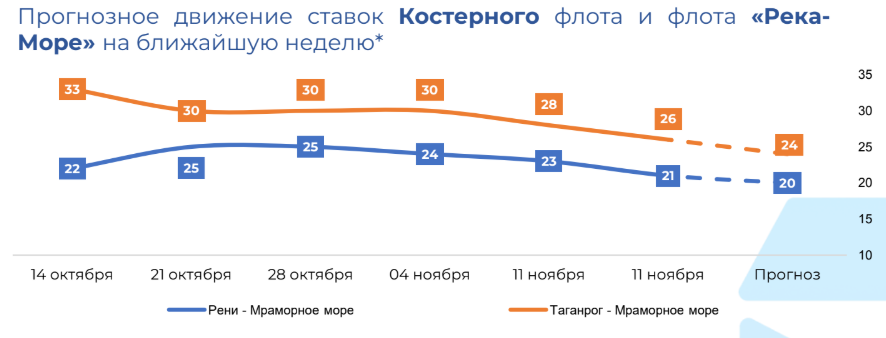

On the Azov Sea market, the situation remains difficult for shipowners. Russian wheat exports to Turkey remain low, which does not allow increasing rates. Deteriorating weather conditions and the upcoming ice campaign somewhat restrain their further drop, as it limits the availability of vessels. In the Caspian Sea, the situation is more favorable – high demand for grain cargoes in Iran supports the market and contributes to the growth of rates. However, in the Sea of Azov, the onset of winter activity is expected to decrease, which may temporarily stabilize rates.

+380 67 625 91 65

+380 67 625 91 65